Understanding Section 111A and Section 112A of Income Tax Act: A Comprehensive Guide - Marg ERP Blog

If you have any questions about tax harvesting please let me know in comments section, will reply to all comments.#march #tax #taxseason... | Instagram

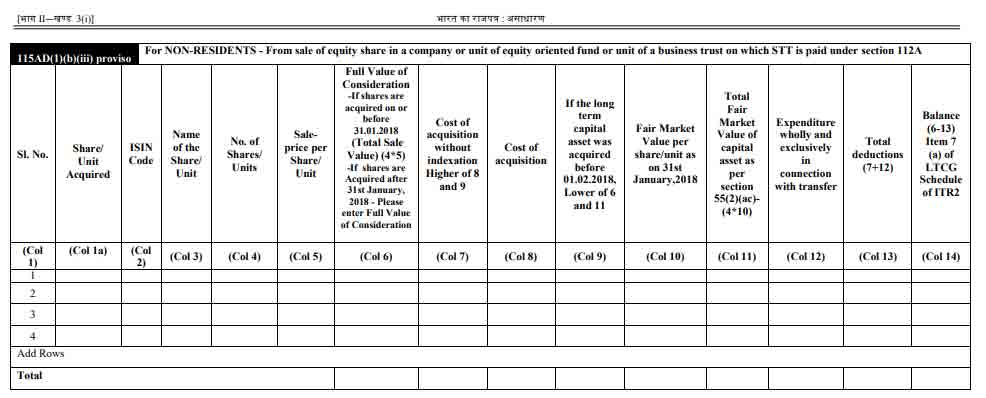

![Opinion] Whether Sec. 112(1)(c)(iii) Applicable to NR Supersede General Provisions of Computing Capital Gains? Opinion] Whether Sec. 112(1)(c)(iii) Applicable to NR Supersede General Provisions of Computing Capital Gains?](https://www.taxmann.com/post/wp-content/uploads/2023/05/5-1-1-1024x600.jpg)

Opinion] Whether Sec. 112(1)(c)(iii) Applicable to NR Supersede General Provisions of Computing Capital Gains?